After struggling for a number of days to regain this necessary psychological degree, Bitcoin lastly broke by way of the $90,000 mark. The transfer comes at a time of intense volatility and sustained promoting stress that continues to dominate market sentiment.

Analyst opinion stays divided, however with BTC buying and selling almost 30% beneath its all-time excessive and failing to determine a convincing restoration construction, there are rising requires a proper bear market to start. Anxiousness stays excessive and confidence amongst each retail and institutional traders has weakened.

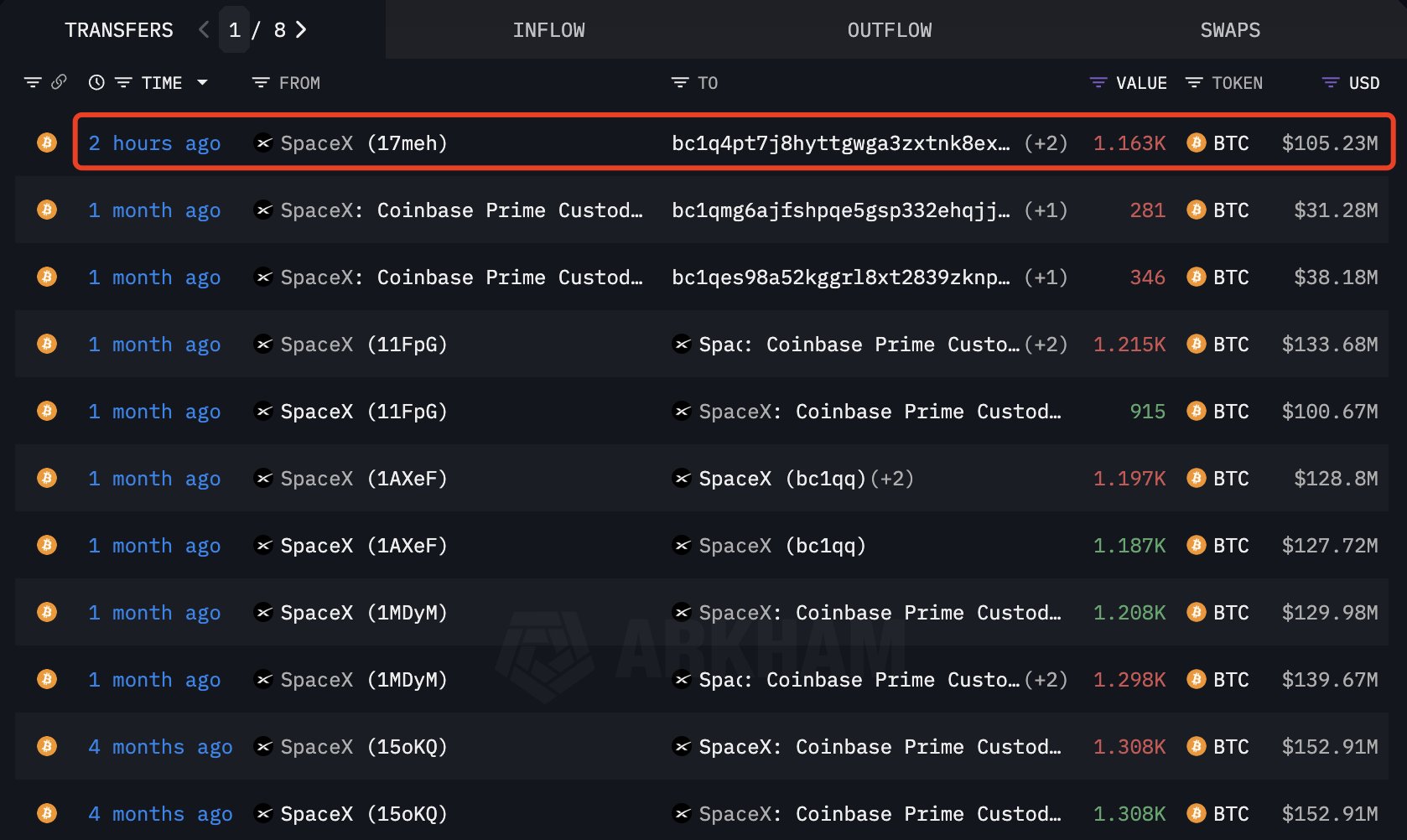

Along with uncertainty, new knowledge arkham It was revealed that SpaceX transferred an extra 1,163 BTC (price about $105.23 million) only a few hours in the past. The cash seems to have been despatched to Coinbase Prime, suggesting a doable change within the firm’s storage location. Such giant actions usually trigger concern available in the market, as they’ll sign place modifications, preparations on the market, or monetary changes by giant company holders.

Whereas Bitcoin’s rise above $90,000 offers short-term aid, it does little to alter the broader narrative that markets stay underneath stress, liquidity is diluted, and macro-driven uncertainty continues to form value tendencies. The upcoming periods will decide whether or not BTC can acquire momentum or return to deeper correction territory.

SpaceX’s Bitcoin transfer provides new layer of market uncertainty

In accordance with data SpaceX from Arkham presently holds 6,095.45 BTC, price roughly $550 million at at this time’s costs. This robust monetary place places the corporate among the many giant company Bitcoin holders, and its latest on-chain exercise rapidly attracted the eye of your complete market.

The most recent switch (1,163 BTC moved only a few hours in the past) marks a significant change in SpaceX’s exercise, particularly contemplating that the corporate has been largely inactive by way of transferring BTC for a number of months.

In accordance with Arkham’s report, that is the primary notable transaction since October 29, when SpaceX transferred 281 BTC to a brand new pockets handle. The motives behind such transfers are unclear, however merchants sometimes monitor such strikes intently as shareholders of huge corporations can affect market sentiment.

As suspected in latest strikes, a transfer to Coinbase Prime usually alerts preparations for storage changes, treasury restructuring, or strategic repositioning.

Thus far, there is no such thing as a clear indication that SpaceX is lowering its publicity to Bitcoin. Nevertheless, the resumption of on-chain exercise comes at a fragile time for a market battling promoting stress, concern and widespread hypothesis {that a} bearish part is coming.

So long as the foremost good cash entities stay lively, Bitcoin’s near-term course is prone to proceed experiencing elevated volatility.

Tried to get well however nonetheless underneath stress

Bitcoin is displaying indicators of restoration after hitting a brand new native low final week, with the value now above $91,000. The chart exhibits a pointy rebound from the sub-$82,000 zone, which served as short-term assist throughout the give up part. Nevertheless, regardless of this rebound, BTC stays beneath all main transferring averages (50-day, 100-day, and 200-day), which reinforces the broader bearish construction.

The latest rally displays short-term easing fairly than a strong pattern reversal. Quantity spiked considerably throughout the decline, indicating pressured liquidations and panic promoting. Nevertheless, the present pullback is going on on low quantity, suggesting that consumers are cautious and haven’t but dedicated to robust conviction.

Structurally, Bitcoin must regain the $95,000-$98,000 zone the place the 50-day transferring common and 100-day transferring common converge.

This space represents the primary main resistance cluster and can decide whether or not the market is transferring right into a restoration or just forming a decrease excessive earlier than one other leg down. Failure to interrupt out of this band may lead to contemporary promoting stress.

Featured picture from ChatGPT, chart from TradingView.com

modifying course of for bitcoinist is targeted on offering completely researched, correct, and unbiased content material. We adhere to strict sourcing requirements, and every web page is rigorously reviewed by our crew of prime know-how specialists and skilled editors. This course of ensures the integrity, relevance, and worth of your content material to your readers.