Keynote

- Solana Value rose above $228 after a contemporary inflow of corporations: $20 million from Mogu and $5 million from Protected Shot Bonk Treasury Enhance.

- The Each day Chart Golden Cross promoted 14% rallies this week, with RSI nonetheless under the extent that was pressured to purchase.

- Key degree: $217-$208 assist, resistance is $240-$250 as merchants acquire momentum from institutional demand.

Solana

Sol

$225.8

24-hour volatility:

1.7%

Market Cap:

122.47 b

Vol. 24H:

$9.69 b

Efficiency on the weekly constructive time slot elevated by one other 2% on Thursday, sending Sol Costs above $228 for the primary time since February 2025. The newest Solana Value-Up arises amid a contemporary capital inflow from a Chinese language-based vogue model known as Mogu.

In the official press releaseMogu confirmed that the board has accredited allocations of as much as $20 million to Bitcoin, Ethereum, Solana and digital currencies, primarily to diversify the Treasury holdings.

The inflow of corporations from China reveals that company crypto adoption tendencies are accelerating amongst main US entities equivalent to Bitmine and Sol Methods, taking over a worldwide dimension.

Specifically, one other instance of company demand throughout the Solana Ecosystem is the security shot (shot) of an organization listed by NASDAQ. Announced the establishment of Bonk Holdings LLC Begin your digital asset technique.

In accordance with the announcement, the newly launched subsidiary added $5 million to Solana’s present second largest Memecoin by market capitalization, with Bonk Treasury totaling greater than $63 million.

Amidst an inflow of crypto methods from Mog, Solana Value rose 1.7% on September 11, 2025 | Supply: CoinMarketCap

Relating to Solana’s worth response, the two% revenue registered on Thursday recorded income for the fourth consecutive day this week since buying and selling at $200 on Sunday. This calm worth rise after two main instances of company inflow means that some income could have undermined the bullish impact.

Solana Value Forecast: Can Golden Cross Momentum push Sol to $250?

The Solana Each day Chart reveals lively golden cross alerts with a five-day transferring common above the 8- and 13-day common initially of the week, a sign usually related to a sustained bullish development. Naturally, Solana Value has recorded a 14% revenue for 4 consecutive days for the reason that Golden Cross Formation. The RSI holds practically 65, leaving extra room for revenue earlier than hitting the acquired territory.

Solana Value trades at $226 at press time, far surpassing preliminary assist, which noticed its five-day common at $217.

Solana (SOL) Know-how Value Evaluation | Supply: TradingView

If Sol continues to consolidate over $220, the subsequent goal might be at $240 earlier than a possible retest of $250, and final reached early January.

On the draw back, if the principle assist areas fail to carry at $217, momentum might return to $208, with a 13-day common offering secondary assist. Solana’s buying and selling quantity could possibly be inspired to enter an extended place to reap the benefits of contemporary company demand catalysts that aren’t but priced on 4% climbs, which greater than double the value rise.

As Solana’s company adoption sparks market curiosity, Subbd Presale beneficial properties momentum

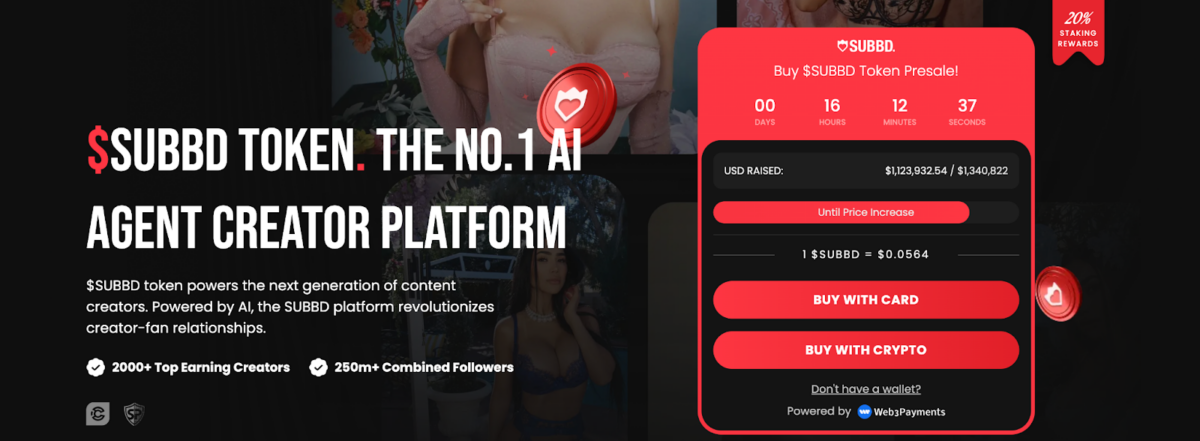

Solana additionally beneficial properties traction in early stage tasks with revolutionary utility options equivalent to SubBD ($subbd). SubBD is an AI-powered platform for content material creators, attracting consideration for mixing creator fan engagement with real-world use instances.

subbd presale

At present, at a worth of $0.056 per token, SubBD Presale has raised $123 million of its $1.34 million goal, with a restricted low cost tier. Future members will be capable of safe SubBD tokens straight by means of the official web site earlier than reaching the CAP.

Subsequent

Disclaimer: Coinspeaker is dedicated to offering honest and clear reporting. This text is meant to supply correct and well timed info, however shouldn’t be thought of monetary or funding recommendation. Market circumstances can change shortly, so we suggest that you simply assessment your info your self and seek the advice of with an knowledgeable earlier than making a call based mostly on this content material.

Ibrahim Ajibade is a veteran analysis analyst with a background in supporting a wide range of Web3 startups and monetary organizations. He holds a bachelor’s diploma in economics and at the moment holds a grasp’s diploma in blockchain and distributes ledger know-how on the College of Malta.