Key takeout

- President Trump has signed a decision overturning IRS guidelines requiring Defi platforms to report crypto transaction knowledge.

- The reversal reduces the overload of Defi contributors with regulatory calls for and helps digital belongings innovation whereas addressing privateness and taxpayer info sharing issues.

Please share this text

President Donald Trump right this moment signed a legislation that overturns IRS guidelines that require a distributed finance (DEFI) platform to report cryptographic transaction knowledge and gather buyer info. press release It was printed by Rep. Mike Carrey and launched the invoice in December final yr with Senator Ted Cruz.

“That is the primary cryptocurrency invoice so far to be signed to the legislation and the primary Tax-Associated Parliamentary Overview Act (CRA) to be signed to the legislation,” the discharge stated.

“The Defi Dealer guidelines had been set to overwhelm the IRS with a brand new submitting overflow that unnecessarily hampered American innovation, violated the privateness of on a regular basis Individuals and lacked infrastructure to deal with throughout tax season. A bureaucratic hurdle,” Rep. Carrie stated. “We wish to thank President Trump for signing the legislation on this vital invoice, and thanks to your management in encrypting the crypto emperor bag and supporting America’s ongoing location as a world chief within the rising crypto trade.”

measurementAlso called HJRES.25, it goals to void the IRS’ “Whole Income Report from Brokers that commonly present companies that successfully and successfully present digital asset gross sales.”

Launched on the final day of Biden’s time period, the principles expanded the definition of “brokers” to incorporate non-mandatory entities equivalent to Defi platforms and buying and selling front-end service suppliers.

As a part of the expanded scope, the Defi undertaking might want to report gross income from crypto gross sales and gather taxpayer knowledge, together with IDs and transaction historical past.

The institution of a decision implies that the principles will probably be “powerless or efficient,” and can quickly abolish the necessities for Defi platforms and different digital asset brokers and report gross sales for FORM-1099.

Its abolition reduces the burden of compliance, just like the Blockchain Affiliation, which has been criticized by many members of the crypto sector as an unrealistic and revolutionary restraint.

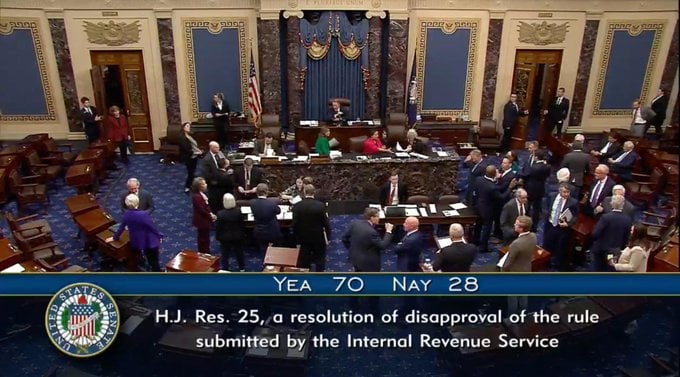

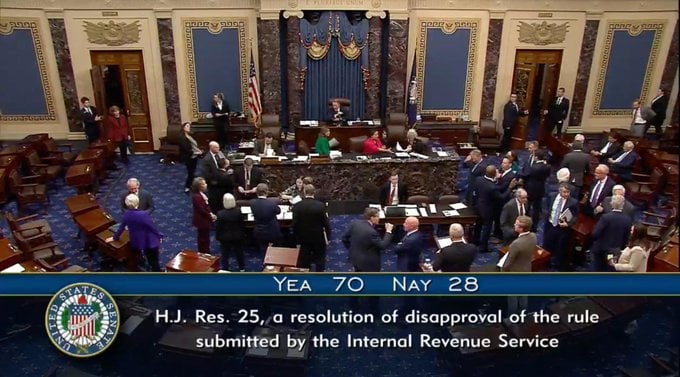

The measure cleared the Senate on March 4th earlier than passing the home the next week. Nevertheless, given the measures’ connection to funds points, a vote of conclusion within the Senate was crucial earlier than handing over to the President.

On March 26, the Senate voted to abolish the controversial crypto tax guidelines.

Beneath the Congressional Overview Act, the IRS can’t subject considerably comparable guidelines with out the permission of a brand new Congress. This prevents brokers from redesigning equal reporting necessities for digital asset brokers with out categorical approval from Congress.

Trump’s signature coincides together with his administration’s common stance, notably in direction of rising applied sciences like Crypto, which he has more and more embraced throughout his 2024 marketing campaign and second time period.

The White Home authorised the decision, claiming in an announcement on March 4th that Biden-era guidelines would negatively have an effect on American innovation, increase critical privateness points associated to taxpayer info, and place an irrational compliance burden on Defi firms.

Please share this text